Throne, an application that allows users to send items to creators from a wishlist, is introducing Happy Wishlist, a new gifting portal designed for family and friends. Nevertheless, the more intriguing aspect of the tale is that the organization opted to leverage its way to success rather than return the capital it had received from investors the previous year.

Starting Throne

Twenty-one years ago, Patrice Becker and Leonhard Soenke established the venture. The calendar management application Meeter, which the duo had previously founded, was acquired by workflow automation startup Bardeen.

With a valuation limit of $30 million, the company raised $830,000 in February via a SAFE note from investors including Ryan Hoover’s Weekend Fund, Z Fellows’ Cory Levy, and Vibhu Norby (B8ta).

A SAFE note is a method of immediate funding that establishes the valuation of the company for a subsequent period of time, typically during the subsequent investment round. A prevalent founder-friendly fundraising approach, this strategy enables nascent enterprises to secure pre-seed or seed capital without immediate dilution.

The co-founders initiated the investigation of the Throne concept when several of their creator acquaintances discussed concerns such as establishing a PO Box, preserving privacy, managing a restricted catalog, and delivery difficulties.

“At the time, no viable solution existed for content creators to receive physical gifts in a secure manner.” “Creator privacy is the central concern; therefore, we serve as a barrier between creators and their fans by concealing the creator’s address from the fan,” Becker explained to TechCrunch.

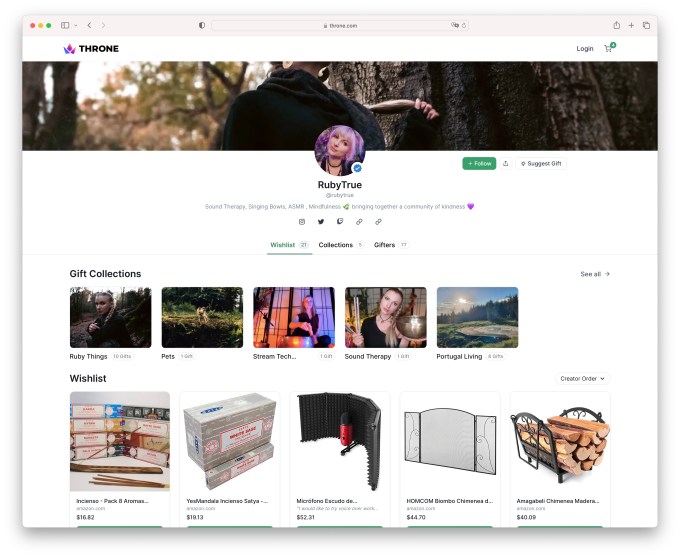

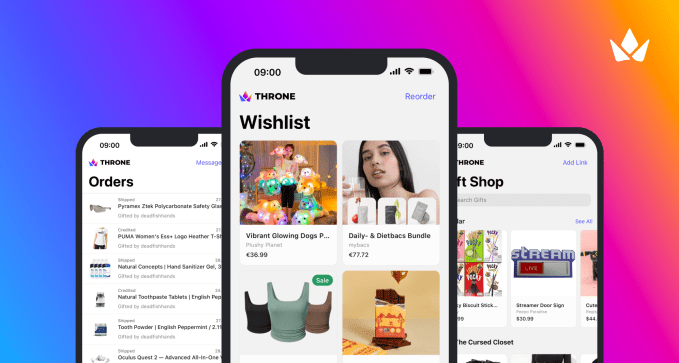

Throne enables users to compile a manifest from a variety of online resources. Fans may present creators with items from the aforementioned list as gifts. By employing Throne, any exposure of personal information, such as addresses or payment details, is prevented for both parties. Additionally, the business permits creators to convert a registry item into a crowdfunded gift.

Throne, a startup that markets itself as a secure solution, garnered media attention for a security flaw. A German security research collective known as Zero Forschung discovered a vulnerability in the platform last year that revealed the private addresses of its creators. Although Throne did not provide specifics, it did state that the bug had been resolved. Additionally, it was stated that an unidentified German expert on data privacy “confirmed that there was no data risk.”

By charging a commission to associate brands whose products are gifted to creators on sales, the startup generates revenue. In order to fulfill orders for non-partner brands, Throne adds a service fee to the price of the gift. Last month, the startup surpassed the milestone of 400,000 creators on the platform.

The organization’s most vital platform is Twitch. A majority of the content creators who registered on Throne did so via a Twitch login. By configuring stream alerts for new contributions or gifts, creators have the opportunity to potentially acknowledge them.

Returning investor money

Prior to raising the seed round in 2021, Throne had surpassed $1 million in monthly gift expenditures with a 50% month-on-month growth rate, according to Throne CEO Patrice Becker. The company subsequently raised a non-dilutive round as a result.

The organization ultimately came to the understanding during the summer of 2023 that the market it is targeting may not yield a venture-backed result. As the company prepared to raise Series A funding, it made the strategic decision to transition towards profitability and refund all investors by December 2023.

“They are’stuck’ in the VC cycle, despite the fact that they could operate profitably despite having a small market size and healthy revenues,” Becker explained. “Liquidation preferences and investor pressure to deploy the capital they raised (often resulting in a high-cost basis) place them in a predicament where they are compelled to anticipate a unicorn outcome.”

“By continuously developing our team to be as lean and efficient as possible, we were able to advance at a rapid rate with minimal administrative burden.” We achieved profitability and a revenue rate in the mid-sevens when we made the decision to reimburse our investors in full. We have established a sufficient safety reserve to permit us to defer the repayment of the investment until we are at ease doing so.

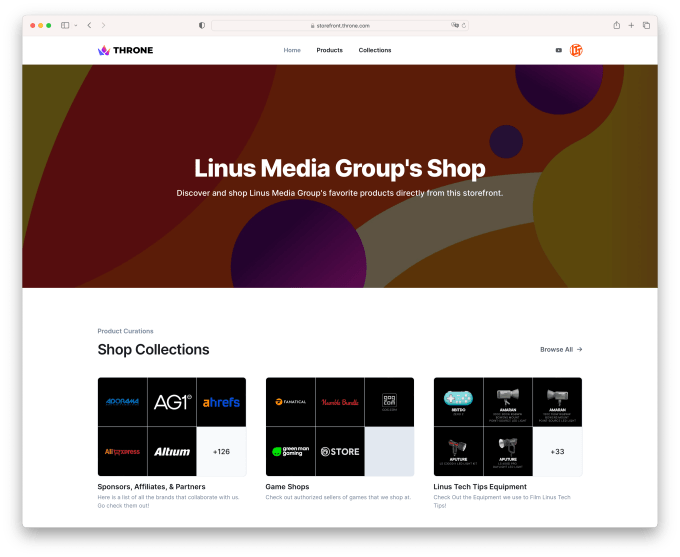

Other products offered by the company include Throne Storefront, a link-in-bio product designed for companies such as Linus Media Group. Throne Exchange, an alternative approach to the traditional Secret Santa system, enables users to exchange gifts without disclosing their addresses. Last year, 1,500 individuals from around the world participated in the Christmas gift exchange, according to Becker. These two verticals each make a negligible contribution to the company’s revenue.

Commencement of the Happy Wishlist

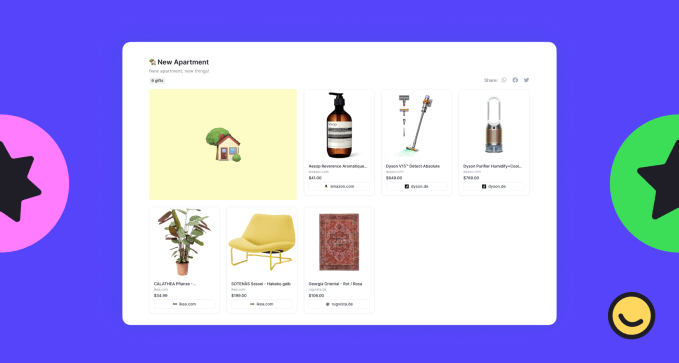

Observing admirers present items to creators as gifts inspired the founders to conclude that wishlist-based gifting can also be prevalent in a personal setting. Happy Wishlist, the newest service from the organization, specializes in assembling wishlists for loved ones. Guests may deliver items from a registry that they personally order to their own address, then deliver them in person to the recipient at a party or event.

Given that items are being delivered to individual addresses by acquaintances, the startup is not required to participate in the fulfillment of orders.

The organization is considering generating revenue via affiliate connections and brand partnerships in which it receives commissions on customer purchases. According to Becker, the startup’s monetization strategy aims to transform Happy Wishlist into a product with “multi-million” revenue within the following year. Throne is essentially already diversifying its revenue streams; rather than seeking to raise capital, it prefers to generate profits.